Grateful to Have a Job

I was raised in a blue-collar family, and I will forever give thanks for that upbringing. There were many times when it was said that an extended family member had a good job. Often it was enhanced to say a “good-paying” job. It was also said in a tone that implied there was not a guarantee that the job was going to be there forever. Actually, I distinctly recall an expression of worry that employment could or might end abruptly.

It was also ingrained in me to work hard. All my early jobs were blue-collar or clerical. I learned early on that I could out-work just about everyone around me. That was my security, in a good way. My first new car was a 1967 VW that costs $1,670 with a $47 monthly payment. I was employed as a paint maker and sought some assurances from my boss that my job was secure. He couldn’t promise anything, but he all but said I was as safe as anyone.

Now, well over a half-century later, I find myself still grateful to have a job. I work for myself, but reputation is only as good as my last job serving my client base. I work just as hard as I did at the beginning. I don’t take it for granted that I will have a job or a client base tomorrow. Every day is a gift.

I try hard not to compare myself to the generations that have followed me. But I don’t sense that fear of losing a job, and perhaps not being able to find another one right away. That’s too bad. That “healthy fear” is good motivation. You tend to deliver more than is expected of you, and often more than you are compensated to do. Everything else being equal, you always want to be the last to be laid off, not the first.

Today most employment evaluations make a distinction between meeting expectations and exceeding expectations. I’ve often wondered why exceeding expectations shouldn’t be what the compensation level is for. Meeting expectations would be an insult to me. I would be bored in a job where all I did is meet expectations. That’s saying average is okay. Not in my DNA.

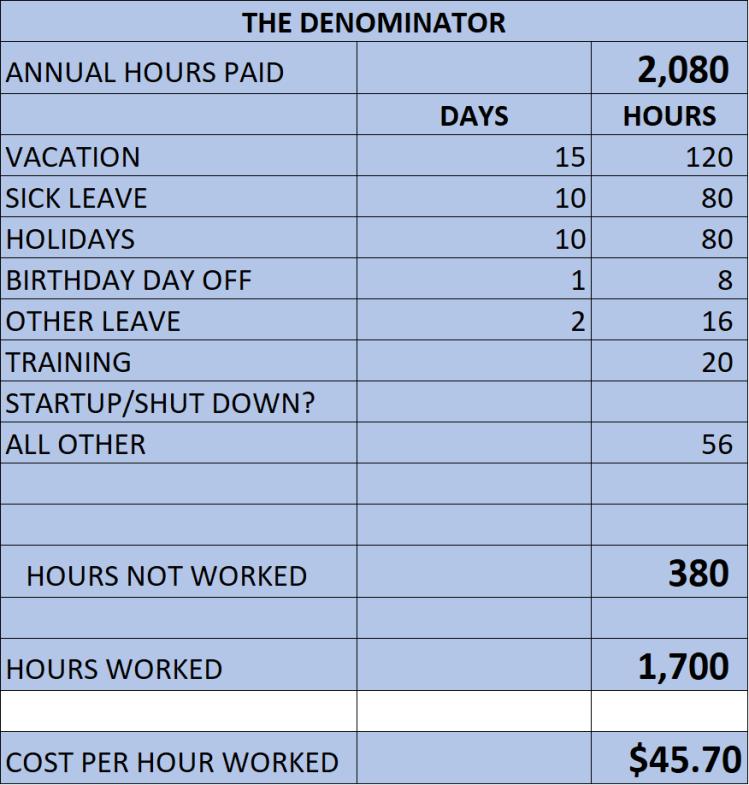

It was years ago that I ran across a boss at a bank who had 30 years of experience. I quickly realized he actually had 1-year of experience 30 times. That’s being a little harsh, but there comes a point when the second 10-years of experience may not have the incremental added value than the first. And the third decade perhaps a little less. Yet that gets very expensive when there is an expectation that the compensation should rise faster than the added value. That’s bad arithmetic.

Only if you have ever had to make a payroll out of your own personal pocket would you understand or appreciate this seemingly cruel statement.

So, on this day, I want to reach out to anybody who will listen to say thank you! From my paper route as a teenager, to all my blue collar jobs as a janitor and construction laborer and then clerical jobs that prepared me for being a professional: I’m deeply grateful for allowing me to work, to serve and to be compensated fairly. I’m rich beyond belief, and I’m not talking about my bank account. To enjoy what one does is a blessing, and I’ve not been idle, unemployed or unhappy for the entirety of my working life. Just the opposite.

And, in even a deeper gratitude, my analytical skills and interests have not waned. I consider local government as the most wonderful laboratory on Planet Earth. I don’t believe I have reached my pinnacle. It’s always been in front of me. Thank God! Although my energy level isn’t what I once had, my intellectual capabilities are still growing. Believe me, I don’t take anything for granted. I just hope to continue growing until I can’t go any longer.

Thanks to you for being a part of my journey. LFM

You must be logged in to post a comment.