McKinney Municipal Utility District No. 1 (MMUD1) is the legal subdivision of the state located in the City of McKinney’s ETJ but not in the city limits as of now. I am going to refer to it as MMUD(s) because documents refer to MUD1 and MUD2, but MUD1 is the Master District. The City has control of a number of construction requirements and is party to an agreement that allows the City to even contract with the MMUD for the City to provide certain services. MMUD was created in the 80th legislature in 2007 by Rep. Jodie Laubenberg as HB 3979.

This MMUD is also the entity involving the Trinity Falls Development. From everything I hear, the Developer is experienced with these kinds of financing vehicles. This blog is not about the developer per se. It is about MUDs in general and the MMUD as an example in particular. MUDs are about helping the developer get a project financed. MUDs are in abundance in the Houston area. Missouri City, as an example, has 25 MUDs in their city limits. MUDs are not so popular North Texas. And for a reason. Take a poll of the Houston area cities with MUDs and ask if they could undo the MUDs today if they could?

MUDs help with leap -frogging development. Leap-frogging is not a positive term. In many cases it means allowing islands to be created. Everybody knows that the best growth management is in contiguous concentric circles, but that never happens like the textbook pictures. There are always people wanting to get away from the city where land is cheaper. And almost always the growth fills in between until the outlanders become just like the city, too.

-frogging development. Leap-frogging is not a positive term. In many cases it means allowing islands to be created. Everybody knows that the best growth management is in contiguous concentric circles, but that never happens like the textbook pictures. There are always people wanting to get away from the city where land is cheaper. And almost always the growth fills in between until the outlanders become just like the city, too.

In the map below from the Municipal Advisory Council (MAC), it shows Collin County in green, McKinney ISD in blue and MMUD in pink. MMUD is 880.42 acres in size. In other disclosures, the Trinity Falls property is shown to be 1,700 acres. Therefore, one must assume that MMUD could expand. I have heard that there will be a MUD3 and MUD4 at some point in time.

The purpose of the MMUD is to sell bonds to pay for the infrastructure (and substantial other costs) put in place by the Developer. By infrastructure, it is meant to be roadways as well as water and wastewater lines. How much in bonds are anticipated? That becomes a very interesting question. We turn to their bond disclosure documents to understand. MMUD shows the authorized debt to be as follows:

$133,050,000 Roadways.

$145,000,000 Water & Sewer System.

$ 10,240,000 Fire Protection Related.

$288,290,000 Total Bonds Authorized.

You are probably asking if this could be correct? It’s going to take $288,290,000 to provide infrastructure for 880 acres of mostly residential development?

Again, we look to official documents to understand. As it turns out, they show only 680 acres of development, and it is all residential. The remainder is for parkland, an elementary school or is undevelopable.

Unless you’ve beat me to it, then $288,290,000 divided by 680 acres is $423,956 per acre. Based on an average of what they have disclosed so far, the average lots per acre is 2.935. That would mean the bond authorization placed on a per lot basis is $144,443 per lot!

Before we go further, it is important to realize that bond authorization does not mean they will sell that much in bonds to repay the developer. However, the significance is still there, and I guarantee you $144,443 is probably not a number shown to the McKinney City Council or that staff bothered to calculate or that the council bothered to ask.

So What If The Lot Cost Is Very High?

You can say that if the buyer wants to purchase a house that has $144,443 in it before any vertical construction begins, then that is their business. But that is why we must dig deeper. If it goes into the value of the house, then you know the full cost. However, homeowners in the MMUD must be on their toes to realize the cost of the house they pay to the builder is only part of their costs.

In addition, they have to pay a MMUD tax that covers the $144,443 per lot:

House Price Paid by Mortgage.

+Infrastructure Paid by MMUD I&S Tax Levy Paid.

= The Full Cost of the House & Property.

The MMUD tax is the issue that can become troublesome. Take a poll today of the MMUD occupants and ask if they understand the MMUD taxes?

How Much Is The MMUD Tax?

There are two parts to the answer. The first is how high could the MMUD Tax be. The McKinney ISD has a maximum rate that is very high. It is a total of $1.67 per $100 value. That is broken down into Maintenance & Operations (M&O) of $1.17 and $0.50 for Interest & Sinking (I&S or Debt Service). Both components are at the maximum the state allows.

The City of McKinney’s tax rate, although not charged to the MMUD property owners, is $0.5830 with $0.4100 being for M&O and $0.173 for I&S. It is nowhere near the maximum allowed by state law.

The MMUD is quite different. The M&O maximum tax rate is $1.20. However, there is no limit on the I&S portion of the tax rate. Therefore, there is no legal limit on the tax rate.

However, the question first at hand is what is the current MMUD tax rate? The answer is $1.05 per $100 broken down into $0.505 for M&O and $0.545 for I&S.

Therefore, if you live in the City of McKinney, the total tax rate is $0.5830. If you live in the MMUD, the tax rate is $1.050.

Okay, So What?

Your next thought might be the same as mine, and that is won’t the house price and taxable value of the house reflect a lower amount since part of the home is financed out of the mortgage and part out of the MMUD tax?

Let’s check. One MMUD home on Sabine is valued at $397,392. The land value is $80,000 for the lot, and the improvement value is $317,392.

The lot is 7,500 square feet or $10.67 per sf. The improvements, based on 3,612 sf would be $87.87 per sf. for a total of $110.02 per sf when the total value is stated on the main area of 3,612 sf.

What do you think? Discounted or not?

Of course, these are Collin County Appraisal District values and not the actual purchase price. The purchase price could have been lower. Or higher.

It must be mentioned that these are the market values as shown by CCAD before any exemptions are taken into consideration.

What We Do Know.

The total tax bill on the example property, before exemptions, would be $3.03696 per $100 when adding in the MISD ($1.67); Collin County ($0.235); College District ($0.08196) to the MMUD’s rate of $1.05.

These are the current year’s rates. The tax rolls will not be certified until July 25, 2016 for the tax bills mailed October 1, 2016 and due January 31, 2017. So sometime between July 25 and October 1, the MMUD will be setting their tax rate for the bill to be mailed by October 1. It could be the same or lower. There is virtually no ceiling on the topside.

When the tax bill is received (again, before exemptions) of $12,068.64 ($397,342 x $3.03696 / $100), the homeowner will realize what they have bought into by being in the MMUD.

Were they told of the MMUD tax potential at the closing of the purchase? Oh, yes, they signed a document along with dozens more when they were just hours away from getting the key. The tax bill may have been incorporated into the mortgage, so the homeowner will have a wake up call to examine their escrow every year when insurance and taxes possibly change. A fully informed potential buyer would be educated when they drove into a subdivision of MMUD. I drove around this morning and didn’t see a sign.

Lewis, Why Do You Care If The MMUD Homeowner Gets Riled?

I don’t. My concerned being raised is about the City of McKinney. Maybe even the County/CCCD. If you read through the documents, you can find quite a bit of language that says, read our lips, the City and the County are not responsible for the debt and payments of MMUD. But you would be quite naïve if you think there are no repercussions.

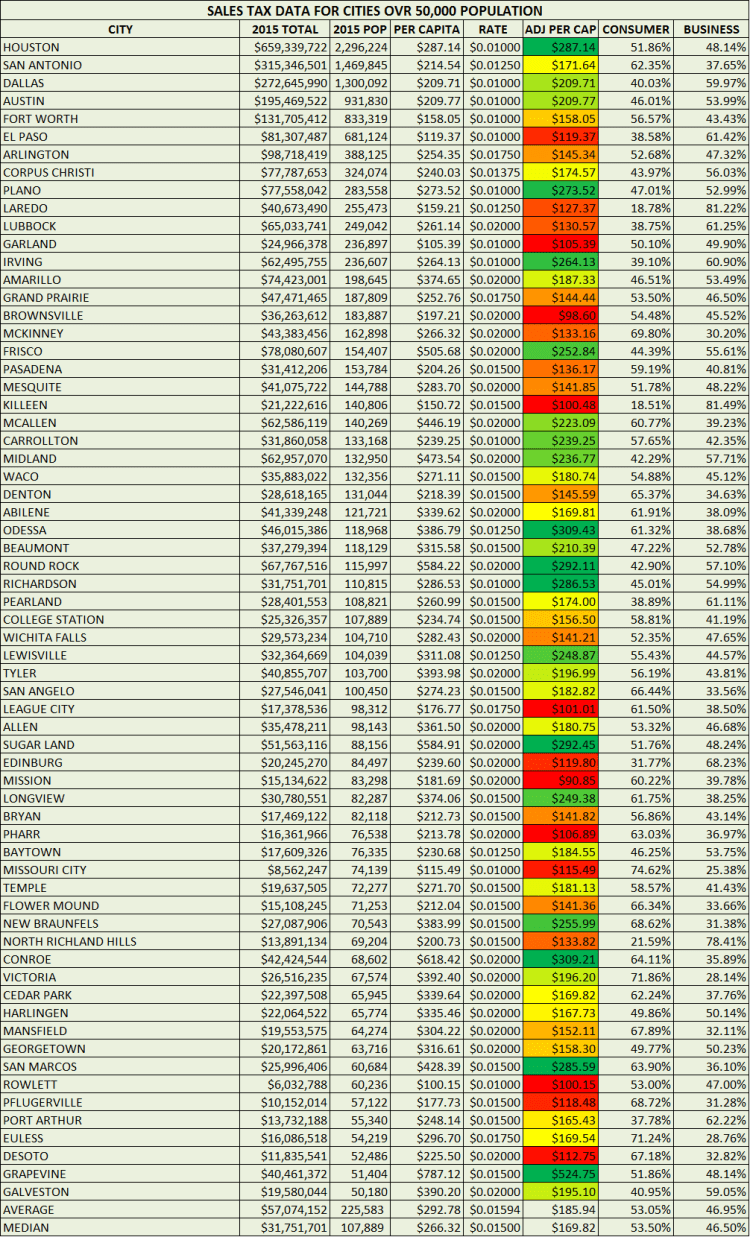

First, I don’t like it that the MMUD has the name “McKinney” in it. If there was ever a MMUD default, the headline would not be favorable for the City. Also, the history of MUDs all over the state is for the homeowners to get restless or irritated with a dose of buyers’ remorse once they realize their tax bill would be lower by $1,846.68 annually ($1.05-0.5853 x $397,392 / $100) if they lived in the McKinney city limits. Take a poll of the highest tax rates in Texas and you will find mostly MUDs at the top of the list.

If the MMUD homeowners believe they got duped paying a competitive price for their house plus a tax rate that included part of their house (meaning they paid twice for part), then embarrassment turns into rage. Especially if they can’t sell their house to escape the burden. Before long they may start wanting to run for City Council to force the absorption of the MMUD by the City AND to absorb the outstanding debt at the time. It HAS happened across the state. If they see that the City is part of the agreement and had plans to incorporate the MMUD, then why not now?

What About The Debt?

Now we are getting to the guts of the matter. The tiny little MMUD has been authorized to issue, $288,290,000 in bonds supported only by the property owners of MMUD. They have issued only $13,800,000 to date in two issues. However, they are ramping up in that $8,070,000 was dated September 1, 2015 with a secondary issue of $5,730,000 dated February 1, 2016. The race is to sell debt as fast as possible to reimburse the developer when there is value on the ground to carry the debt service.

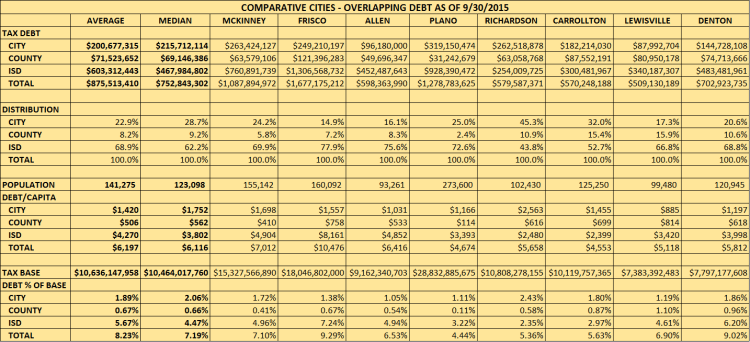

For a perspective, the entire outstanding debt for all of Collin County is $379,084,150! For all of the City of McKinney, the outstanding tax related debt is $307,790,000!

Do you see my concern?

Can the City of McKinney control the issuance of more debt until they have confirmations there is not going to be a negative impact on the City, legal, public relations or other? The answer is yes and no.

By contract, the City has placed a cap of $120,000,000 of debt issuance on MMUD unless they approve to raise the level.

So, Lewis, why don’t you shut up and wait until a problem crops up? First, I’m not geared that way. My entire career has been about worrying over things that could blow up. But the real reason is that I was waiting for the audited financial statements for the MMUD for their fiscal year ending March 31, 2016.

Then something happened on the way to the wait station.

The McKinney City Council shows a workshop agenda for tomorrow night and a Council meeting agenda item on Tuesday night to amend the 2012 agreement. McKinney does a horrible job of providing background before a meeting as I complained about in my last blog. First, they claim the amendment resolution preamble is in the best interest to the City. Quite noble, but they don’t explain the benefit. In fact, there is no staff paper, no real back story, no staff recommendation.

What the amendment does say, to me, is that MMUD is being given permission to raise the debt issuance limit to $262,800,000!

Why in the world if there is already a $120,000,000 cap with only $13,800,000 issued would MMUD need to lift the cap right now?

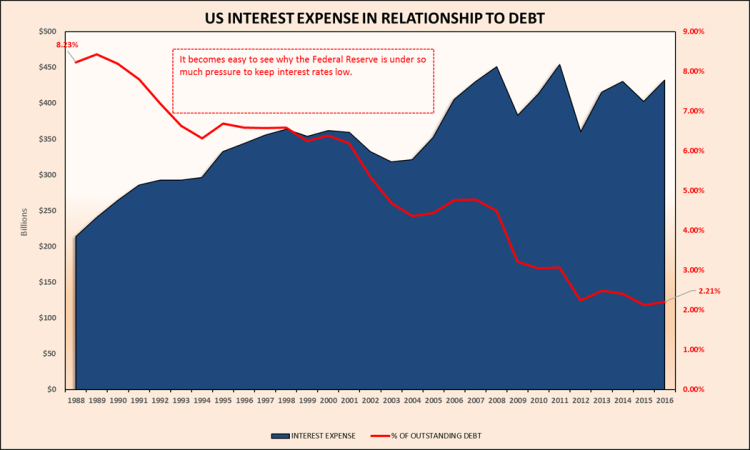

And nobody seems concerned that all debt issuance and taxes entity have a bearing on each other. A $million of debt uses everybody’s debt capacity. A penny tax increase is a penny of taxing capacity the resident can afford.

Conclusion & Recommendation.

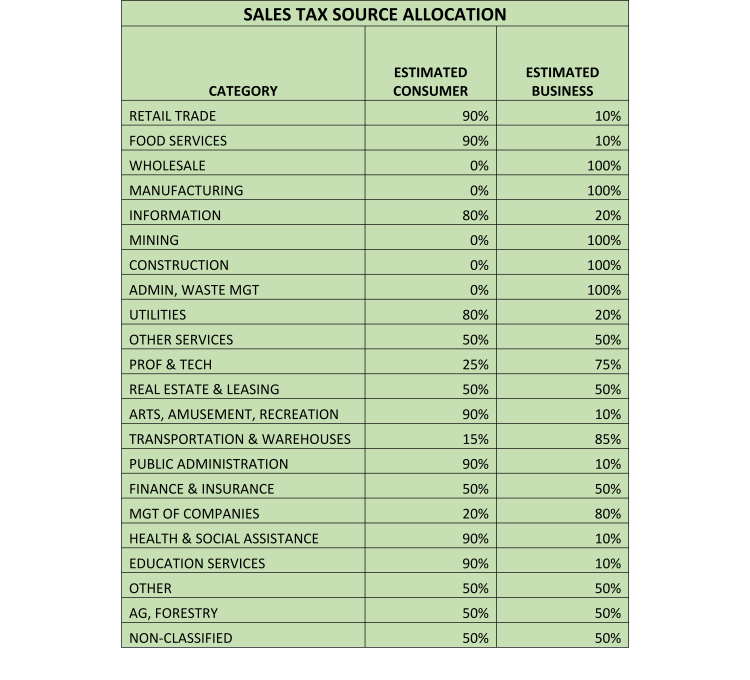

I am concerned how we allowed a MUD to get created in McKinney in the first place. Yet bigger, since we are only about 50% built-out and tens of thousands of acres left to be developed, how are we going to say no to the next Houston-style method of incentivizing a developer? In fact, why are we incentivizing residential development at all? In addition to allowing the MUD financing vehicle, the City is granting a sales tax split to MMUD!

I am requesting of the City Council that this agreement amendment be postponed until the middle of July when the audited financial statements should be finished as well as the certified tax roll be delivered.

More importantly, I suggest the City Council require a five-year plan be provided to the City Council when additional bonds are issued and made a requirement for City approval to go forward with future bonds. The financial plans should show the lot and construction pipeline as MMUD already discloses now to bond holders in their official bond issuance statement. The plan should also show the tax value assumptions, the debt issuance/debt service assumptions as well as the tax rate component forecast for the next five years. It is with 100% certainty that MMUD has this information.

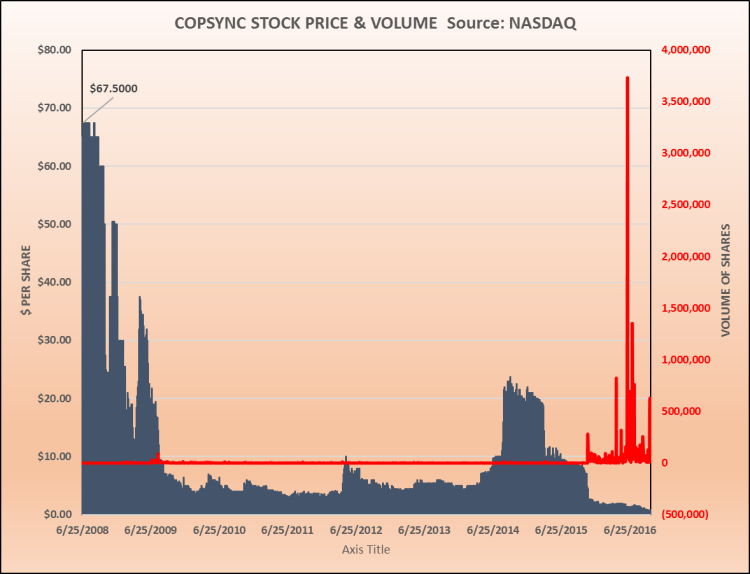

In fact, the bond rating agencies would be insisting to see this information. Except there is one problem: these bonds are not rated nor or they guaranteed by a bond insurer. And there is a reason for their absence. Only very sophisticated buyers would be interested in these bonds. And there is a premium they earn for the risk. Take a poll of the interest rates on these and other MUD bonds compared to typical tax supported bonds.

At this point, I am not suggesting that toothpaste can be put back into the tube. However, the MMUD board meetings should be held in McKinney and the City needs to be involved in monitoring. The MMUD now shows bookkeepers, financial advisors, bond attorneys and auditors all being from Houston. They are very smart people with absolute perfect knowledge of how MUDs work. I have to wonder if the City of McKinney asked their own financial advisors and bond attorneys the pros and cons of allowing a MUD to be created in the ETJ? Who did the due diligence on this proposition from the beginning and since the inception?

Ironically, they show Chandler Merritt, Public Works Director of the City of McKinney, as a finance-connected official according to the Municipal Advisory Council. Go figure!

Lastly, it should be noted that 29.1% of the $13,800,000 in bond currently outstanding went toward soft costs (legal fees, financial fees, capitalized interest and other non-construction costs). There is an entire cottage/mansion industry in Houston related to MUDs. We really need to think long and hard about the potential for MUDs to proliferate in North Texas.

Nobody thinks through how these animals end, but there are many stories of ugly exits as they take on a life of their own and want to be absorbed when it is in the best interest of the MUD. But my overriding concern is that a council known for making decisions without full public disclosure really needs to monitor the MMUD and any MUD in the ETJ. LFM

C

C

-frogging development. Leap-frogging is not a positive term. In many cases it means allowing islands to be created. Everybody knows that the best growth management is in contiguous concentric circles, but that never happens like the textbook pictures. There are always people wanting to get away from the city where land is cheaper. And almost always the growth fills in between until the outlanders become just like the city, too.

-frogging development. Leap-frogging is not a positive term. In many cases it means allowing islands to be created. Everybody knows that the best growth management is in contiguous concentric circles, but that never happens like the textbook pictures. There are always people wanting to get away from the city where land is cheaper. And almost always the growth fills in between until the outlanders become just like the city, too.

You must be logged in to post a comment.