McKinney is asking for citizen input for the upcoming budget at tonight’s meeting. Since most citizen comments are limited to only three minutes, I am opting to blog my observations on sales tax revenue assumptions.

I monitor sales tax revenues for every city, county, transit authority and special district in Texas every month. That would be over 1,600 local governments. Due to the beating levied on the oil patch regions in Texas, the total collections have been relative flat for about 18 months. But the total $8 billion annual local government base has been stable and is now growing again.

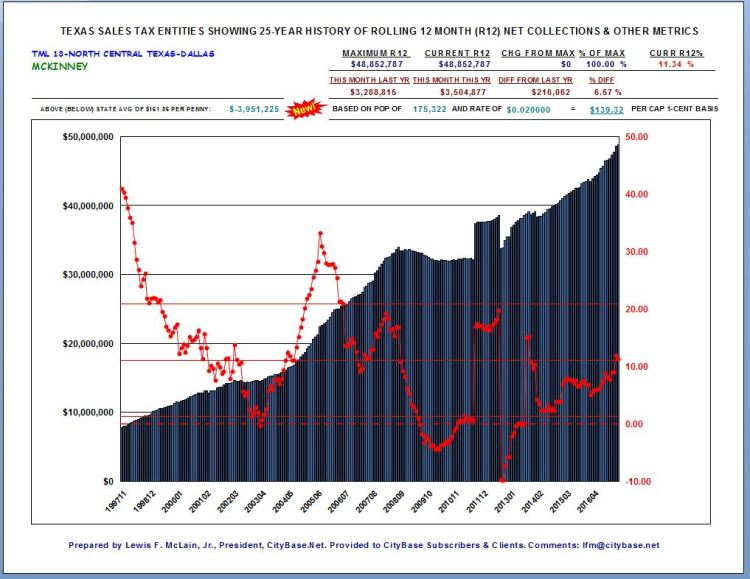

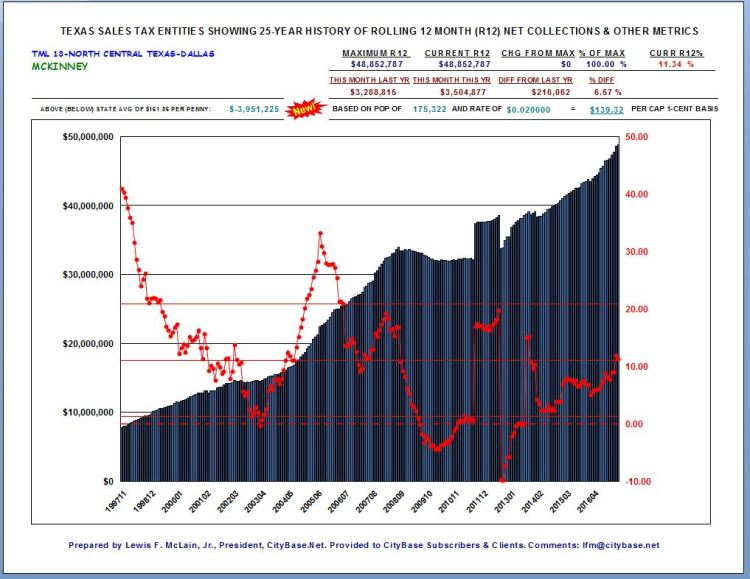

However, while many regions have suffered, that is not the case for others such as in North Texas. The collections have been robust in the DFW area. Let’s look at McKinney in particular. On a Rolling 12-month (R12) basis, there has been constant growth at an impressive rate since the Great Recession. As of April 2017, the City has collected $48,852,787 in the last 12 months, the highest ever. Just about every month is another record breaker.

The annualized growth rate is 11.34%! The R12% is the most telling and sensitive indicator of growth. It will announce slowing, peaking, bottoming and recovering points way before you can grasp the changes in dollars. The R12% is an incredibly robust metric for McKinney. Double-digit growth is difficult to sustain. But half that amount isn’t.

April 2017’s check was $216,062 higher than April 2016 or 6.57% more.

By the way, you can see the anomalies such as the positive $5 million + Audit Adjustment McKinney received back in 2011. The R12 spiked for exactly 12 months and then returned to its strong growth trend.

But let’s shift our attention to the Sales Tax Per Capita calculation. On a statewide level, Texas local governments are receiving $161.86 per capita on a 1-cent basis. McKinney is collecting $139.32 on that same basis. That can be translated into $3,951,225 below average or twice that amount since McKinney collects the full 2-cents allowed for local governments. But we knew that even before the City spent money to have a “leakage” study done in recent years.

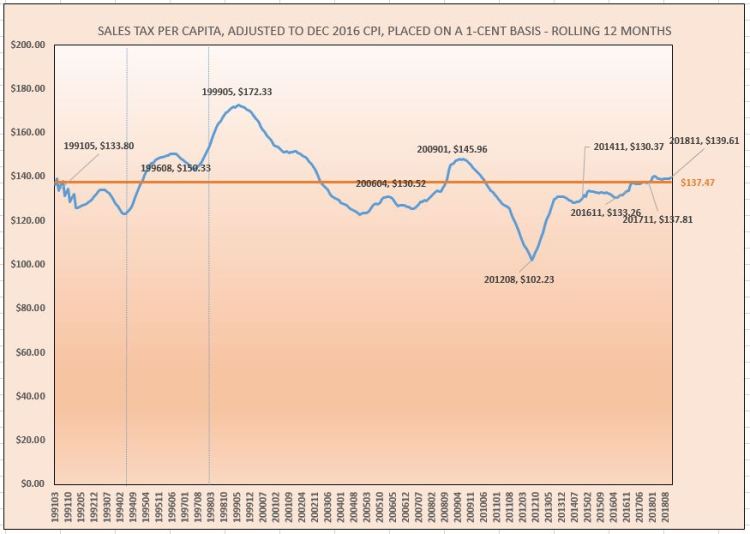

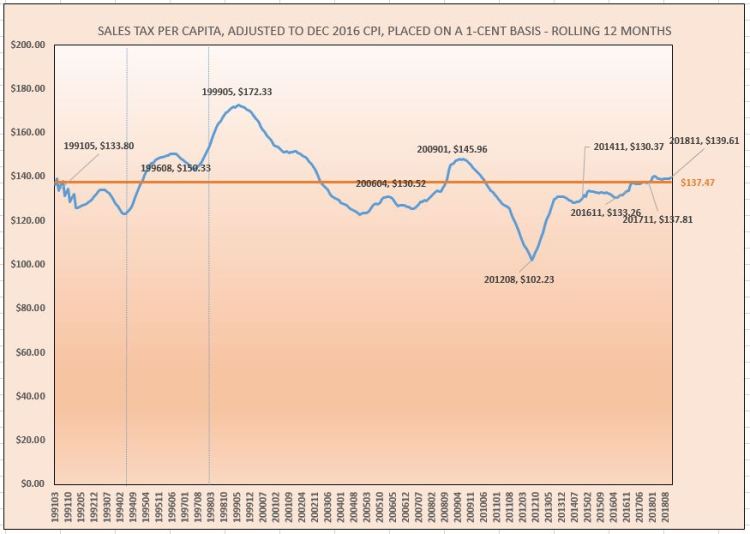

But let’s put $139.32 per capita into perspective. I prepared the chart below a few months ago and have not updated it. However, the value remains. It is instructive to look at McKinney’s Sales Tax Per Capita when you can see several years of history and adjust the calculations for inflation (CPI).

You can see the fluctuations that come from a mix of population growth and economic peaks and valleys. You can see clearly where McKinney has been in recent years. This metric was $133.26 at the end of the fiscal year 2016. I had projected that it would rise to at least $137.81 at the end of the current fiscal year and then up to $139.61 at the end of FY 2018, the budget year for which input is being requested. I was intentionally slightly conservative. I used an inflation rate of 1.75% when it is likely to be above 2.00%.

This estimate translates into the following, again, on a 1-cent basis:

- FY 2016 $23,594,961 Actual without any audit adjustments.

- FY 2017 $24,917,139 or 5.60% higher than FY 2016.

- FY 2018 $26,367,347 or 5.81% higher than FY 2017.

So, there’s my input.

In looking at the agenda packet for tonight, I find a presentation that indicates a sales tax growth rate of 2.06%! It does not say whether the growth rate is going to be applied to the 2017 Budget, the 2017 Revised Budget or any other base. That’s important. It appears to be scientific in that it is the composite of the Fed Median GDP Projection; the 10-Year Dallas Fed PCE; the 10-Year Rolling Average; and the Low 5-Year Average.

Hold on a second. I’m not sure any those are logical linkages. Here is what I do know. I have prepared some very sophisticated sales tax modeling algorithms in my career. And no matter the degree of complexity or academic statistical excellence I worked into the model, my last step had to include dividing the numerator by the denominator (residential population and employment) to come up with a Sales Tax Per Capita value.

Questions Abound

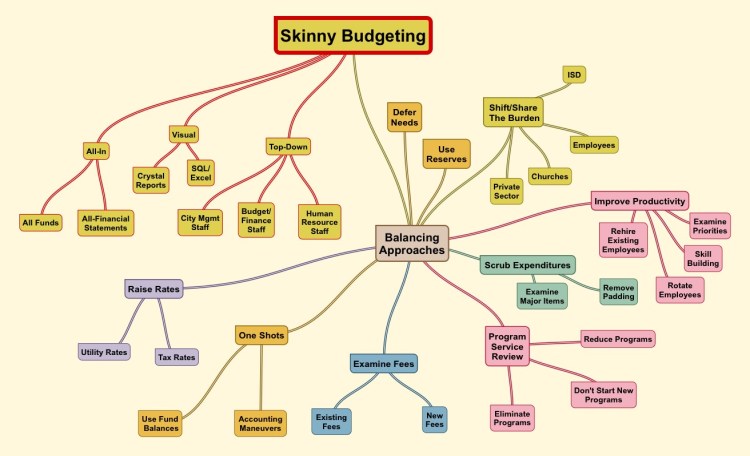

On the surface, the concept of making conservative estimates sounds noble and smart. But here is the problem. Actually, there are several problems. If you are too conservative (lowering revenue estimates and raising expenditure assumptions), then what is there to manage?

One can brag about how the spending came in under budget. Big deal. Not to hard to do with enough padding.

One might even brag about how money has been “found” mid-year to come in and save the day for new need, especially a political need. In my career, I have seen how eventually nobody needs to fight for resources during the budget. Just know that the real budget “tightening” will come when the budget is revised mid-year in face of the true income and spending levels. Except “tightening” can turn into new-found money (oh how I hate that phrase).

The net result of being overly conservative, other than the kudos for rescue funding mid-year, is that reserves get boosted. But then that argument gets abused. If you have 60 days of operating reserves, wouldn’t 90 be better? Well, if big is better, then why not build reserves up to 180 days. Where do you stop?

Next, comes the most insincere and most abused argument of them all: “the bond rating agencies want big reserves or else they will drop the bond rating.”

Rage sets in on me. I’ve watched the McKinney finance staff shut down a legitimate question asked by a councilmember by simply invoking the “Bond Rating Agency Threat.” Grounds for dismissal in my book. Especially the Deputy City Manager who directs the financial staff. He knows the game, and recent abuses have been on his watch.

But here’s the deal. The bond rating agencies place a high degree of emphasis on fiscal management, including controls and planning. They will even hang with you if you are in trouble. They mainly want to know a couple of things: 1) do you know you are in trouble; and 2) do you know how to get out of trouble?

Want to know how the bond rating agencies will react to something? Go ask them! They are approachable. Plus you pay them a big fee to be rated.

Here’s something else I know. McKinney is flush with reserves after years of overly conservative budgeting. I won’t be handing out a badge of honor for big reserves when there are legitimate needs for spending – or to cut the tax rate.

And I know this. Overly conservative sales tax budgeting boosts the need for property tax revenues. It works like this. A penny on the tax rate produces about $1,700,000. A one percent change in the sales tax revenue equals about $260,000. Low ball the sales tax revenue by 4% and you need the property tax rate equivalent of $1,400,000 or a TRE of about 6/10 of a penny. ($260,000 x 4) / $1,700,000.

So, do this at the McKinney meeting tonight: ask for the Budget vs Actual for Sales Tax Revenues for the past five years. Ask what the revised FY 2017 sales tax revenue estimate is expected to be now that nearly half the year has gone by. LFM

BTW, if you want to see the first chart for every entity in Texas, you can download my charts I prepare monthly. It’s a big PDF file.

You can view “StatewideCharts201704.pdf” at: https://files.acrobat.com/a/preview/8bd7f399-4e3a-48e0-a717-50b9b92e7125

stole the show. Gratitude to God and family came from the lips of most of the newbies. But you simply must watch this clip of the meeting at the 40 minute 48-second mark. I’m expecting that it will make your day as it did those of us serving as witnesses. I think it is a sign of things to come for McKinney governance and leadership.

stole the show. Gratitude to God and family came from the lips of most of the newbies. But you simply must watch this clip of the meeting at the 40 minute 48-second mark. I’m expecting that it will make your day as it did those of us serving as witnesses. I think it is a sign of things to come for McKinney governance and leadership.

You must be logged in to post a comment.