We Can’t Afford to Stay Alive

A collaboration between Lewis McLain & AI

Longevity, Hidden Costs, and the Obligation We Never Could Afford

We have achieved something extraordinary. Modern medicine has extended human life far beyond what any previous generation thought possible. Hearts are restarted. Organs are replaced. Diseases that once killed quickly are managed for decades. Death, increasingly, is postponed.

But longevity has come with a reckoning we continue to avoid: the longer we live under modern medicine, the more expensive—and often the more diminished—life becomes. And the bill for this achievement is not abstract. It is measurable, enormous, and largely invisible.

1. The Cost Curve We Pretend Not to See

Healthcare spending does not rise evenly across a lifetime. It accelerates sharply after age 65 and even more steeply after 75. By the final years of life, annual medical spending commonly reaches $30,000–$40,000 per person, often much higher when hospitalizations, intensive care, dialysis, and skilled nursing are involved.

These dollars rarely purchase recovery. They purchase maintenance—keeping organs functioning as the body steadily declines. Survival is extended, but vitality shrinks. Independence narrows. The space for joy and contribution contracts.

We have learned how to keep bodies alive.

We have not learned how to keep those added years whole.

2. Longevity Without Living

Extended life is usually framed as an unqualified good. Yet for many people, the additional years are marked by:

- Chronic pain and fatigue

- Loss of mobility

- Dependence on institutions

- Endless appointments and medications

- A shrinking world defined by medical routines

The paradox is hard to escape: the more medicine we apply, the narrower life often becomes. We stretch time while quietly hollowing out what fills it.

3. The Mind Ages on a Different Clock

Physical decline is only part of the story. The body and the mind do not fail together—and medicine is far better at sustaining one than preserving the other.

Millions spend their final years with significant cognitive decline:

- Dementia

- Alzheimer’s disease

- Loss of memory, recognition, and orientation

In those years, the cruelty is subtle but profound. Lifelong friends are forgotten. Spouses become strangers. Children become caregivers to someone who no longer knows their name.

Medicine can often keep the body alive long after identity, memory, and relationship have begun to fade. These are years of biological survival, not the life most people imagine when they say, “I want to live as long as possible.”

4. What the System Is Actually Buying

Late-life healthcare spending increasingly funds not restoration, but management of decline:

- Memory-care facilities

- Hospitalizations for falls, infections, and complications

- Medications to control agitation and confusion

- Constant supervision rather than healing

This care is often compassionate and necessary—but it is not curative. We are not extending life as people envision it. We are extending dependency, supervision, and medical captivity.

5. The Hidden Bill: Medicare and the Great Disappearing Cost

The reason this system persists with so little public reckoning is simple: the price is hidden.

Medicare absorbs the overwhelming cost of late-life medicine and spreads it across workers, employers, borrowing, and future taxpayers. At the bedside, care feels earned and affordable because the bill never arrives.

But when economists ask what Medicare actually costs under current law, the answer is staggering.

The present value of Medicare’s future obligations—discounted into today’s dollars and net of dedicated revenues—is commonly estimated between $50 trillion and $85 trillion over a 75-year horizon. Some longer-horizon analyses, including work associated with the Federal Reserve Bank of Dallas, place the figure well above $100 trillion when extended beyond the artificial cutoff of 75 years.

These are not hypothetical programs. They are legal promises already made.

6. Put It Where It Belongs: Per Household

Large numbers dull the mind. Per-household figures sharpen it.

With roughly 130 million U.S. households, the math becomes unavoidable:

- Medicare unfunded obligations:

~$400,000 to ~$650,000 per household, depending on assumptions - Current national debt (~$34–35T):

~$260,000 per household

Even under conservative estimates, Medicare’s future obligations exceed the national debt on a per-household basis. And unlike the debt, Medicare’s costs cannot be refinanced, inflated away, or postponed indefinitely. They represent real doctors, nurses, facilities, drugs, and care delivered every year.

The national debt is what we argue about.

Medicare is what we quietly promise.

7. The Pre-Retirement Parallel We Ignore

This illusion does not begin at 65.

The Affordable Care Act performs the same cost-concealing function for pre-retirement generations. By subsidizing premiums, suppressing actuarial pricing, and prohibiting underwriting, it hides the rising cost of aging bodies between ages 50 and 64.

Without subsidies, many near-retirees would face insurance premiums rivaling housing costs. The shock would be immediate—and politically intolerable.

Together, the systems form a seamless bridge:

- ACA conceals costs before retirement

- Medicare absorbs them after retirement

At no point does the public see the full cost curve.

8. Why This Is More Serious Than “Debt”

The national debt is a stock.

Medicare is a machine.

Debt grows because Congress borrows.

Medicare grows even if Congress does nothing—because people live longer and medicine does more.

It is politically invisible, structurally automatic, and morally shielded from scrutiny by the language of compassion.

9. The Question Beneath the Numbers

“We can’t afford to stay alive” is not a rejection of care or compassion. It is recognition of a mismatch:

- We can extend biological function

- But we cannot indefinitely preserve dignity, clarity, and meaning through technology alone

When price signals are fully suppressed, society defaults to the most expensive answer every time: one more treatment, one more year, one more intervention—even when what is being preserved no longer resembles life as the person understood it.

10. Toward a More Honest Compassion

A humane future does not mean less care. It means wiser care.

That means:

- Earlier and honest conversations about goals of care

- Treating comfort and peace as successes, not failures

- Valuing palliative and hospice medicine as achievements, not retreats

- Acknowledging that identity, memory, and relationship matter as much as pulse and oxygen

Longevity was medicine’s triumph.

Wisdom must be its successor.

Until then, we will continue to spend sums larger than the national debt—quietly, automatically, and without consent—

extending lives that feel increasingly unlike living,

and reassure ourselves it is progress because the machines are still running.

WHAT ABOUT THE FACT THAT RIGHT NOW IT APPEARS THAT THE OBAMA CARE SUBSIDY IS GOING AWAY? IT IS AT OUR DOORSTEP.

Addendum: The Subsidy Cliff Is No Longer Theoretical

One more fact now pushes We Can’t Afford to Stay Alive from theory into immediate reality:

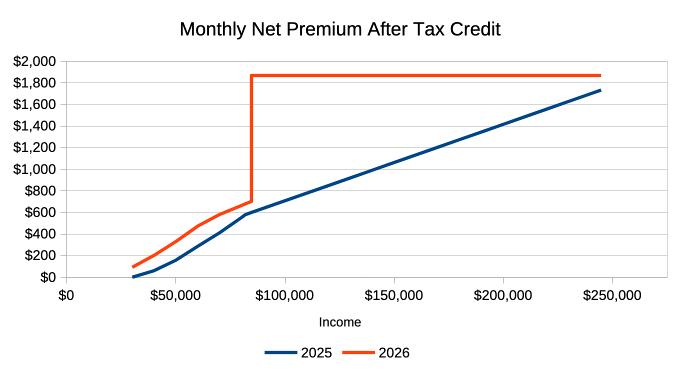

The Affordable Care Act’s enhanced premium subsidies are scheduled to expire unless Congress acts.

This is no longer a distant budget debate. It is at our doorstep.

And when those subsidies disappear, the hidden cost structure we’ve been describing will be exposed overnight—for millions of pre-retirement households.

1. What the Subsidy Was Really Doing

The ACA subsidy did not reduce healthcare costs.

It reassigned who paid them.

For people ages roughly 50–64—the most expensive group outside Medicare—the subsidy:

- Suppressed actuarial pricing

- Capped premiums as a share of income

- Masked the true cost of aging bodies

- Prevented mass exit from the insurance pool

In effect, it acted as Medicare’s front porch.

As long as the subsidy existed, Americans moved from employer insurance → ACA → Medicare without ever seeing the full cost curve.

2. What Happens When the Subsidy Goes Away

When subsidies expire:

- Premiums for many near-retirees will double or triple

- Deductibles will reassert themselves as the real rationing mechanism

- Healthy individuals will exit coverage

- Risk pools will deteriorate

- Insurers will reprice upward again

This is not a policy failure.

It is price discovery returning after years of suppression.

The sticker shock will feel sudden only because the cost was hidden.

3. Why This Matters for the Medicare Argument

This moment matters because it proves your thesis in real time.

The ACA subsidy was never sustainable on its own—it only worked because:

- It borrowed against future taxpayers

- It assumed continued expansion of Medicare enrollment

- It postponed the reckoning until after age 65

When that bridge weakens, Americans see—briefly—what private insurance actually costs when:

- Age

- Chronic disease

- Medical intensity

are priced honestly.

And what they see is unbearable.

Which is why the political pressure to restore or extend the subsidy will be immense.

4. The Pattern Is Always the Same

- Costs rise with age

- Subsidies hide the increase

- Removal reveals the truth

- The public reacts in shock

- Subsidies are reinstated

- Obligations grow larger

This is not accidental.

It is how entitlement systems expand without consent.

5. Why This Moment Is Dangerous—and Revealing

If subsidies lapse even briefly, Americans will experience something rare:

A glimpse of what medically extended life actually costs before Medicare absorbs it.

For many households:

- Insurance will cost more than housing

- Coverage will feel optional until illness strikes

- Early retirement will become impossible

- Financial stress will accelerate health decline itself

The response will not be restraint.

It will be demand for re-subsidization.

And once restored, the system will be even harder to unwind.

6. This Is the Real Choice in Front of Us

We are not deciding whether to be compassionate.

We are deciding how honestly to be compassionate.

Do we:

- Continue hiding costs through layered subsidies?

- Or confront the reality that longevity, as currently structured, is fiscally and humanly unsustainable?

The ACA subsidy cliff makes one thing undeniable:

The system only works when people are shielded from what staying alive actually costs.

7. Why This Belongs in the Essay—Not the Footnotes

This is not a side issue.

It is the live demonstration of everything the essay argues:

- Medicare hides the cost at the end

- The ACA hid the cost on the way there

- When either veil slips, panic follows

- And the response is always to hide the price again

Not because the public is immoral—

but because the truth is unbearable without a deeper conversation about limits, dignity, and what medicine is truly for.

8. The Reckoning Is Not Cancelled—Only Deferred

If the subsidy is extended, the numbers grow.

If it expires, the shock arrives.

Either way, the math does not change.

We can extend life.

We can subsidize it.

We can hide the bill.

But we cannot escape it.

The subsidy cliff is not the crisis.

It is the moment the curtain lifts—just long enough for people to see what has been quietly building behind it.