Another Project for the McKinney Suckers

This is the way it starts out. Unfortunately, the story sounds good:

Resort hotel coming to McKinney?

By Marthe Rennels

Community Impact

April 20, 2016

Craig Ranch could soon be home to a new resort hotel if David Craig’s plans come to pass.

Craig of Craig International and developer of Craig Ranch presented a plan to McKinney City Council during a work session April 18 that included plans for a 250-room resort hotel.

The proposed resort-hotel would include 15,000 square-feet of indoor meeting space and an additional 3,000 square-feet of available meeting space at the TPC clubhouse. Plans also include two ballrooms, two or three breakout rooms and one boardroom.

“We desperately need hospitality near the McKinney Corporate Center,” Craig said. “This is an opportunity to bring one of the essential developments and attractors to the corporate center in the form of a hotel that brings many of the amenities required by corporate America: meeting space, dining and overnight stays on campus.”

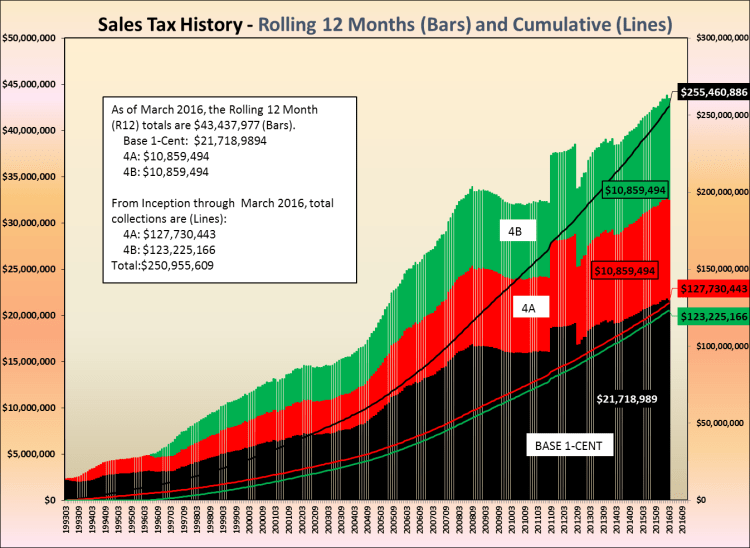

Craig said the occupants of the hotel would have access to the TPC Golf Course in Craig Ranch, an added bonus that he said would encourage weekend stays and help provide additional sales tax revenue in McKinney. On-site restaurants are included in preliminary plans, and the hotel’s future management firm, Aimbridge Hospitality, said it is open to amenity requests from the city and public.

According to the presentation, the estimated construction cost is roughly $68.75 million. Craig requested the city council allow the city manager’s office to speak with Aimbridge Hospitality in hopes of establishing some type of partnership with the city in terms of McKinney Community Development Corp. or McKinney Economic Development Corp. funds.

“I do think this is an opportunity for all concerned,” Mayor Pro Tem Travis Ussery said.

The timing is uncanny. There are two enormous projects in McKinney that have turned into a money pit. The first and most significant is Craig Ranch. The second is known as the Gateway Project. The Gateway Project has been a series of nightmares with lawsuits, project delays and investors jumping in and pulling out.

I have made a Open Records Request to try to obtain documents that would allow me pull together the total dollars the City of McKinney has spent on both. There has been cash, infrastructure improvements, impact fees and other fees waived and … well, that’s just it, I don’t know just how much more. That’s what I wanted to find out. You can ask for records, but the first thing you are told is that the law doesn’t require the City to answer questions. How interesting.

On April 1, 2016, I made a request for two things:

- “I would like to request records that would show the total costs incurred by the City for the Gateway Land and All Related Projects, irrespective the name of the project or payee.

- I would also like to request records that will show the total costs incurred by the City for any aspect of the Craig Ranch project, irrespective of the name of the project of payee.”

Anticipating a clarification letter I often get, I try to add some explanation to my request:

- “I am seeking to determine the entire financial investment the City of McKinney has made in the ‘Gateway Project’ as well as the ‘Craig Ranch Property’ irrespective of the names of the payees or conduits. For instance, if money was paid for a parcel of land but was wired through an attorney, then those items would be included in [the] ORRs.

- While I emphasize ‘total costs’ this is meant to convey all costs. However, I am requesting detail check payments, wires or any kind of transfers of money by fund: Capital Projects, Bond Funds, General Funds, Utility Funds, MEDC/MCDC funds.

- The definition of ‘total costs’ includes any direct or indirect payments, reimbursements, infrastructure expenditures, land purchase, and any waivers of building permits, impact fees or other waivers. It should also include any city in-kind payments or services other than administrative costs. For instance if the city paid for any surveying costs related to a land transaction, those are costs that should be included in my ORR.”

I guess I failed in trying to be explicit. I received a clarification letter anyway. I didn’t explain the term “All Related Projects” in my first request. Okay, mea culpa. These projects have boundaries. Money Pit 1 and Money Pit 2 have lines on maps encircling the projects. How much has the City put into those two Money Pits? I’ll try to rephrase and improve on my ORR later today.

The second clarification has to do with the specific documents I am asking for that reaches into development agreements, contracts and a litany of things. I am forewarned that these documents may be voluminous and entail significant staff time to locate and compile. Okay, I’ll work on that one today, also. I think know I am convinced that I want everything. I was told before I requested the information that the City won’t be very happy to dig into the amount of money that has been spent just on the Gateway land.

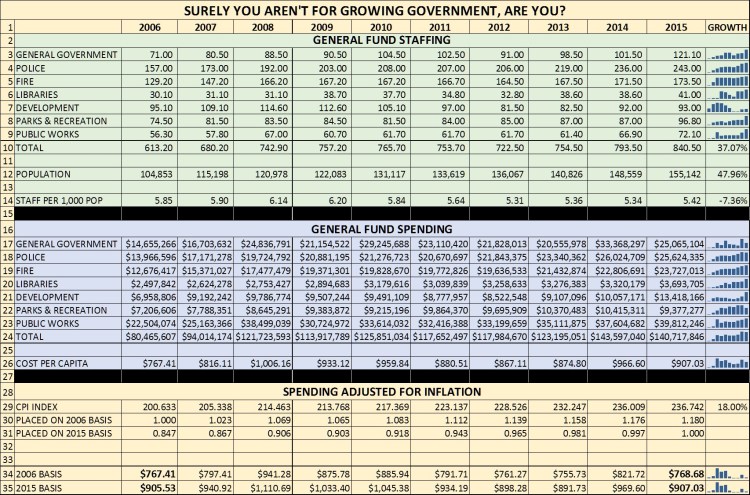

However, this brings me to a complaint I have made to both the Mayor and Interim City Manager as well as the City Council. Everything I am asking for is what THEY should be asking to see. Maybe not detailed documents. But as of April 22, 2016, do THEY even have a clue how many dollars have gone into these two projects since they pulled up to the City’s Money Pumps?

Why am I the one having to ask? THEY are telling me this information hasn’t been asked before! If so, you would just point me to the link on the City’s Web site where that information has been compiled and made public already. Oops! Apparently that’s not what they mean by transparency.

So, here’s the deal. I want to know, but THEY don’t apparently. So THEY are going to make me pay to get some of the most profound information that has ever come out of the City of McKinney! Information that would likely be a citizen’s first question to ask when David Craig came calling yet AGAIN!

Mayor Pro-Tem Ussery thinks this may be a good opportunity for “all concerned,” but I’m not so sure. And some others may be wanting to get a little better educated before making that bold statement. There is no doubt in the world that this is a good opportunity for David Craig.

Mr. Mayor and City Council, at one point in time, the City had invested zero on these two projects. How much has been invested as of April 22, 2016? You say you treat the City’s money like it was your own in an attempt to convey stewardship and fiduciary responsibility. Why aren’t the new council members asking for an independent forensic audit? Would someone go in an shake the members of the City’s audit committee and tell them to wake up. Oh wait, I think it is chaired by Mayor Pro-Tem Ussery.

Any project works as long as there are sufficient subsidies to build it and make a profit for the developer.

By the way, what is the capacity and the utilization rate of the Gateway Hotel? Where is the demand study for a resort hotel in Craig Ranch? What will the room rates have to be? Or do you plan to pump $millions into another project and just hope it works out? An investor using their own funds would never put money into something so large without an independent study showing there is a demand. Well, a smart investor.

Speaking of smart investors. According to the news media, the money behind Craig Ranch appears to be from the Van Tuyl Group, one of the largest auto dealerships in the country. Warren Buffett has now purchased the Van Tuyl Group. Ask Mr. Buffett what the Craig Ranch development is worth at this point and how much more money he is willing to invest in it.

The City of McKinney has put $millions into Craig Ranch. Don’t put another penny into this developer’s pocket. LFM

You must be logged in to post a comment.